|

|

|

|

|

The financial rewards of entrepreneurship in healthcare have long attracted ambitious practitioners seeking both professional autonomy and economic prosperity. For wellness professionals contemplating the leap from employee to business owner, the decision often hinges on a critical question: Can private practice deliver the financial freedom and professional fulfillment they seek? The evidence suggests a compelling case for those willing to embrace the entrepreneurial path.

According to a study analyzing data from 2001 to 2015, self-employed physicians had higher median annual earnings compared to their employed counterparts.

The transition from clinical practitioner to practice owner represents a fundamental shift in professional responsibilities. This transformation requires the systematic development of a business infrastructure that aligns with established professional standards while maintaining financial sustainability. It is a well-trodden path; an analysis of physician employment trends indicated that as of 2022, 55% of physicians worked in private practices.

This comprehensive 12-step roadmap will guide you through the entire process, providing the clarity and tools you need to build your dream practice with confidence. We will demystify the complexities and give you an actionable blueprint for a grand opening that’s both successful and fully compliant.

Step 1: Clarify Your “Why” & Vision

Before you scout locations or register a business name, the foundational work begins within. A well-defined strategic vision provides the framework for operational decision-making and maintains organizational focus during periods of challenge and ensures your practice remains authentic to you.

Start by brainstorming your personal mission. Define your professional motivation and intended market impact through systematic self-assessment. Who do you feel most called to serve?

Next, get laser-focused on your ideal client. Building a detailed avatar helps you tailor your services, marketing, and even your office decor to attract the people you can help most effectively. Vague targets lead to vague results, so be specific.

Mini-Exercise: Your Ideal Client Avatar

| Demographics: Age, gender, occupation, location |

|

| Conditions: What specific physical or mental health challenges are they facing? (e.g., chronic low back pain, postpartum anxiety, athletic performance) |

|

| Goals: What are they trying to achieve? (e.g., run a marathon pain-free, reduce stress, avoid surgery) |

|

| Payer Type: Are they private-pay, using insurance, or a mix? |

With this clarity, you can craft a powerful vision statement using the SMART framework. This transforms a vague dream into an actionable goal.

SMART Vision Statement Template

My practice will be the leading provider of [Your Speciality] for [Ideal Client Avatar] in [Your City/Region] by [Date], achieving this through [Key Service Offerings] and resulting in [Measurable Client Outcome] and [Your Financial/Lifestyle Goal].

Step 2: Craft a Business Plan

A business plan is your strategic blueprint. It is not just a document for lenders; it is a vital tool for proving your concept’s viability to the most important investor: yourself.

This plan forces you to analyze your market, define your value, and project your financial future.

Start with a market analysis. Who are your competitors, and where are the gaps in service? What is the demand for your specific niche?

Local Market Gap Analysis

| Competitor Type | Services Offered | Pricing Model | Identified Gap / Opportunity |

| Local Chiropractic Clinic | Adjustments, E-stim | Insurance-based | No soft tissue or massage therapy |

| High-End Day Spa | Relaxation Massage, Facials | Premium Private-Pay | Lacks clinical/therapeutic focus |

Next, define your services and pricing structure. Create a clear menu that demonstrates value at different price points. As a final consideration, create a simple 12-month financial projection that is realistic, accounting for both revenue and key expenses.

12-Month Profit & Loss (P/L) Snapshot

| Month 1 | Month 6 | Month 12 |

| Revenue: $2,500 | Revenue: $7,000 | Revenue: $12,000 |

| Expenses: $4,000 | Expenses: $4,500 | Expenses: $5,500 |

| Net Profit: -$1,500 | Net Profit: $2,500 | Net Profit: $6,500 |

Common Funding Sources:

| Personal Savings (Bootstrapping): Full control, no debt, but higher personal risk |

|

| Small Business Administration (SBA) Loans Favorable terms, but requires significant paperwork |

|

| Business Line of Credit Flexible access to cash, good for managing cash flow fluctuations |

|

| Equipment Financing Spreads the cost of major purchases like tables and machines |

Step 3: Choose Your Revenue Model: Private-Pay vs Insurance vs Hybrid

This decision profoundly impacts your administrative workload, income potential, and the clients you attract. There is no single "right" answer; the best model depends on your specialty, location, and personal tolerance for administrative tasks. A hybrid model can offer the best of both worlds but requires meticulous policies.

| Model | Pros | Cons |

| Private-Pay | Immediate payment, full control over rates, minimal paperwork, treatment autonomy. | A smaller potential client pool requires strong marketing to justify value. |

| Insurance-Based | Built-in referral network, perceived credibility, access to a larger client base. | Lower reimbursement rates, payment delays, complex billing/credentialing, treatment dictated by payer. |

| Hybrid | Diversified income streams, serves a wider range of clients, flexibility. | Complex administration requires clear policies to avoid confusion, potential for billing errors. |

If you choose to accept insurance, be prepared for the credentialing process. This involves verifying your credentials with each insurance panel, which can be a lengthy administrative journey. Expect this process to take anywhere from 3 to 6 months before you are officially in-network.

Step 4: Secure & Design Your Business Space

Your physical space is an integral component of your brand and the client experience. The search begins with a practical checklist, including accessibility, proper zoning, and ADA compliance. These non-negotiables come before any aesthetic considerations.

For most new practices, leasing is the more financially prudent option, as it requires less upfront capital. After securing the space, the next step is outfitting it with professional, reliable equipment. Your equipment is a long-term investment in your ability to provide excellent care.

Modality-Based Equipment Checklist:

- Massage Therapy: High-quality massage tables or electric lift tables are essential for ergonomics and client comfort. A portable massage chair is excellent for community events.

- Esthetics: Your setup may require spa tables, facial steamers, magnifying lamps, and hot towel cabinets.

- Chiropractic & Physical Therapy: Core equipment includes chiropractic drop tables, exam and treatment tables, electrotherapy (e-stim) units, and ultrasound machines.

To conclude, as you design your floor plan, keep HIPAA privacy rules in primary consideration. Ensure treatment rooms are soundproof or use a sound masking system. Waiting areas should be arranged so that conversations at the front desk cannot be easily overheard.

Step 5: Name & Brand Your Practice

Your practice's name and brand are its identity. A great name is memorable, easy to pronounce, and hints at what you do. Before you commit to a business name, run it through a practical filter.

Brand Name Checklist:

| Memorable & Simple Is it easy for clients to remember and spell? |

|

| SEO-Friendly Does it include keywords related to your service or location? |

|

| Legally Available Is the name already in use in your state? Check your Secretary of State's website. |

|

| Digitally Available Is the domain name and social media handles available? |

Use these tools to check for digital availability quickly:

- GoDaddy or Namecheap for domain searches.

- Namechk.com to check availability across dozens of social media platforms at once.

Consider a basic trademark search on the USPTO website. If you plan to expand, consulting with an intellectual property (IP) attorney is a wise investment. Once you have a name, think about your visual brand and the emotions your colors will evoke.

Step 6: Choose a Legal Structure & Incorporate

Selecting the right legal structure is a critical decision that impacts your personal liability, tax obligations, and administrative requirements. This step protects your personal assets from business debts and lawsuits. Most practitioners will choose between an LLC, PLLC, or S-Corp.

| Entity | Liability Protection | Taxes | Best For |

| LLC (Limited Liability Company) | High (Protects personal assets) | Pass-through (Profits taxed on personal return) | Most solo practitioners and small group practices. |

| PLLC (Professional LLC) | Highest (Required for certain licensed pros in some states) | Pass-through | Clinicians in states that mandate this structure. |

| S-Corp (S Corporation) | High | Pay yourself a "reasonable salary" + distributions (can offer tax savings). | Practices with significant profits (typically >$50k/year). |

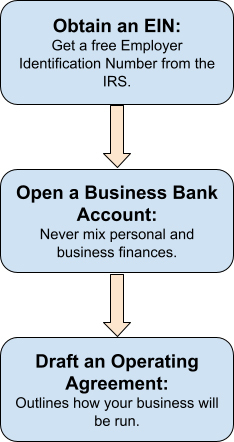

After choosing your structure and registering with your state, you must complete these critical next steps:

While you can file the paperwork yourself, it is highly recommended to consult a lawyer or CPA. They are essential partners in risk management and can ensure you choose the best structure for your long-term goals.

Step 7: Obtain Licenses, Permits & Insurance

Compliance is non-negotiable in the wellness industry. Operating without the proper credentials can lead to hefty fines and jeopardize your career. This step involves a multi-layered check at the state, county, and city levels.

Key Credentials Checklist:

- State Professional License: This is your primary license to practice (e.g., LMT, PT, DC). Ensure it is active and be aware of your state's renewal cycle and continuing education requirements.

- Business License/Permit: Your city or county will likely require a general business operating license.

- Special Permits: Depending on your location and services, you may need additional permits like a health department permit. Check your local municipality's website.

Equally important is securing the right insurance to protect your business, your clients, and yourself. Budgeting for these policies is a fundamental startup cost.

Essential Insurance Coverage:

- Professional Liability Insurance: Protects you against claims of negligence or harm. (Avg. Cost: $400 - $1,500/year)

- General Liability Insurance: Covers "slip and fall" incidents and other accidents in your office. (Avg. Cost: $300 - $1,000/year)

- Property Insurance: Protects your equipment, furniture, and the physical space itself. (Avg. Cost: Varies widely)

For official guidance, always refer to authoritative sources from your local and state governments for permits and professional organizations for compliance standards.

Step 8: Implement a HIPAA-Compliant EHR & Tele-health Platform

An Electronic Health Record (EHR) system is the hub of your practice, handling scheduling, billing, and clinical notes.

When selecting an EHR, HIPAA compliance is the most critical feature. The platform must be willing to sign a Business Associate Agreement (BAA), a legal contract that obligates them to protect your clients' health information.

HIPAA Security Rule Mini-Checklist for Tech:

| Access Controls: Can you set user permissions to limit who sees what? |

|

| Data Encryption: Is all PHI encrypted both at rest and in transit? |

|

| Audit Logs: Does the system track who accessed or modified patient records? |

|

| Business Associate Agreement (BAA): Will the vendor sign a BAA? If not, it is not a compliant option. |

Many modern EHRs now include integrated tele-health capabilities, allowing you to conduct secure video sessions. This expands your reach and offers convenience to clients. As you choose, compare leading platforms based on your specific needs.

| Feature | Health | SimplePractice |

| Core Audience | Nutritionists, Health Coaches | Therapists, Mental Health |

| Billing | Robust insurance & private pay | Strong, with optional biller services |

| Telehealth | Integrated, includes group sessions | Integrated, secure platform |

Telehealth Gear Tip

A professional tele-health setup requires more than just software. Ensure a clear, professional image with a high-definition webcam and good lighting.

Look for secure HD webcam bundles that provide everything you need for a compliant and high-quality virtual session.

Step 9: Prepare Mandatory Client Paperwork & Policies

Your client paperwork is a collection of legal documents that establish consent, define policies, and ensure compliance. Having a complete packet ready before your first client is essential for professionalism and risk management. Your intake packet should be reviewed by a lawyer familiar with healthcare in your state.

Required Forms Checklist:

- Client Intake Form: Gathers demographic, medical history, and payment information. (Retention: At least 7 years post-treatment)

- Informed Consent for Treatment: Explains the proposed treatment, risks, benefits, and alternatives. (Retention: Indefinitely)

- HIPAA Notice of Privacy Practices (NPP): Informs clients of their privacy rights. You must obtain a signed acknowledgment. (Retention: 6 years from last signature date)

- Financial Policy Agreement: Outlines your fees, cancellation policy, no-show fees, and payment procedures. (Retention: 7 years)

- Release of Information (ROI) Form: Authorizes you to share their information with other providers.

Using a HIPAA-compliant e-signature platform streamlines this process, saving paper and time. If you plan to hire or supervise pre-licensed staff, ensure you have additional paperwork for supervision contracts and logs, as required by your state licensing board.

Step 10: Build an Intake Workflow that Converts

A smooth and professional intake workflow is your first opportunity to build trust with a potential client. It guides an interested person from their initial inquiry to their first booked appointment. Every touchpoint should be seamless, reassuring, and efficient.

Sample Phone Script Snippet

"Thank you for calling [Your Practice Name], this is [Your Name]. How can I help you today?... I can certainly help with that. To make sure we're a good fit, could I ask you a few questions about what you are experiencing? ... Based on what you've told me, I believe our [Service Name] would be very beneficial. Our next available opening is [Date/Time]. Would you like to book that?"

Automating parts of this process optimizes operational efficiency. An ideal workflow might look like this:

- Potential clients fill out a "Contact Us" form on your website.

- An automated email is immediately sent with a link to your online scheduler.

- Once an appointment is booked, another automated email sends them a link to complete their intake paperwork online.

- A reminder email or text is sent 24-48 hours before the appointment.

Tracking key performance indicators (KPIs) helps you identify and address deficiencies in your funnel.

| KPI | What it Measures | Goal |

| Inquiry-to-Booking Rate | The percentage of inquiries that become booked appointments. | > 50% |

| No-Show Rate | The percentage of booked appointments that do not show up. | < 10% |

Step 11: Create Your Startup Budget & Expense Tracking

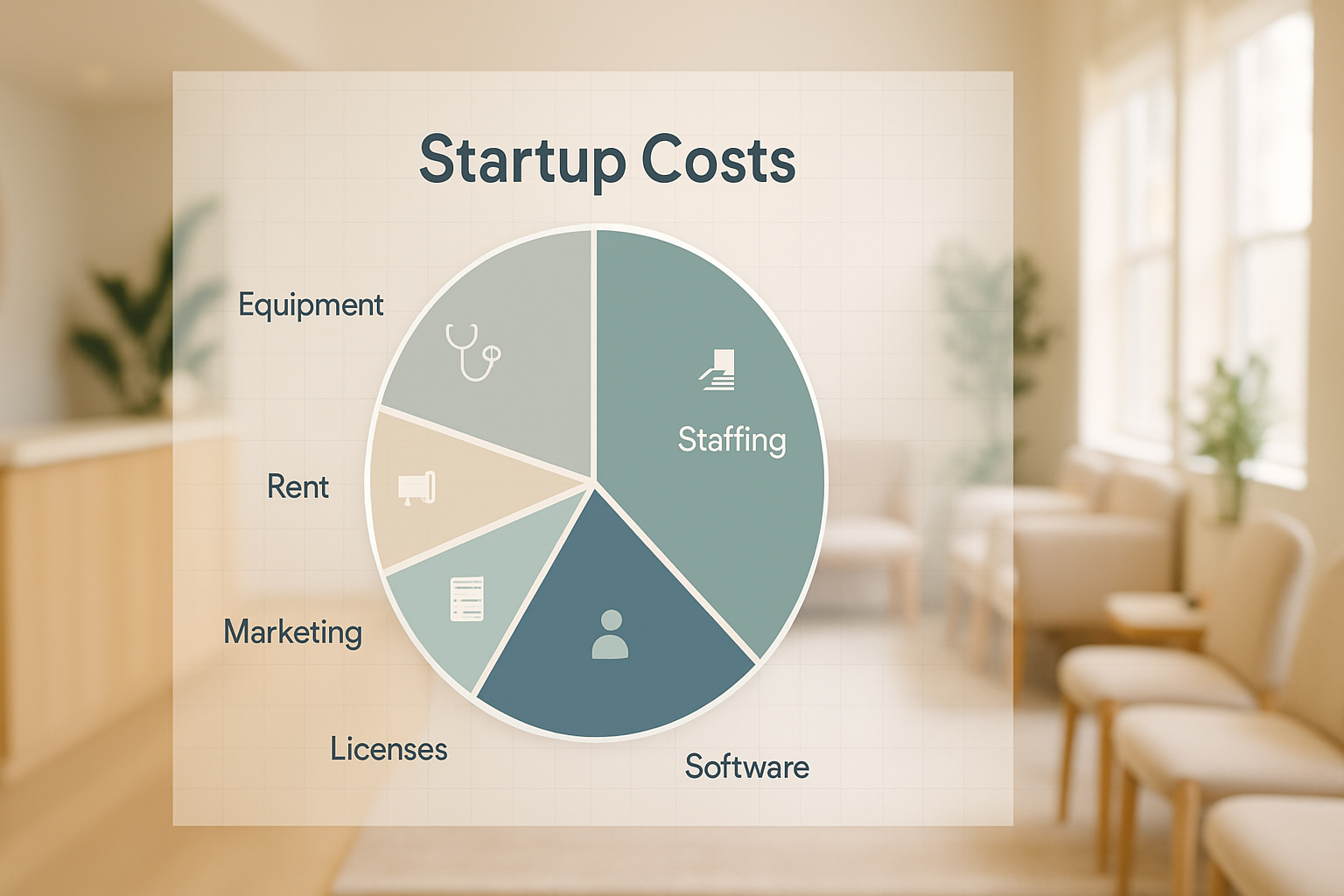

Understanding your numbers is the difference between a hobby and a business. A detailed startup budget identifies every cost required to open your doors. An ongoing expense tracking system is vital for managing cash flow and preparing for taxes.

A visual pie chart of these costs often reveals that professional fees, rent deposits, and equipment make up the largest initial investments. Once you are open, managing your monthly cash flow becomes the priority, helping you anticipate shortfalls and identify opportunities for growth.

Several software platforms can simplify your bookkeeping:

- Wave: Free accounting software, great for solo practitioners just starting out.

- QuickBooks: The industry standard, highly robust, and scales with your business.

- Xero: A strong QuickBooks competitor known for its user-friendly interface.

Finally, stay on top of your tax obligations. As a business owner, you are responsible for paying estimated taxes quarterly. Mark these dates on your calendar and set aside a percentage of every payment you receive (typically 25-35%) in a separate savings account.

Step 12: Marketing Essentials & Pitfalls

![]()

Clinical excellence alone is insufficient for practice success; strategic market visibility is essential for sustainable business development. Marketing is the engine that drives client acquisition. A helpful way to think about it is through the sales funnel: Awareness, Consideration, Conversion, and Loyalty.

Essential Starter Marketing Tactics:

- Local SEO: Start with the basics. Create a free Google Business Profile and get your practice listed in key online directories like Yelp and your professional association's registry.

- Referral Partnerships: Build relationships with complementary professionals who serve your ideal client, such as medical doctors, gyms, yoga studios, or attorneys.

- Content Marketing: Choose one platform and be consistent. Start a blog answering common client questions or create short educational videos. Provide value first.

Common Marketing Pitfalls to Avoid:

- "Shiny Object Syndrome": Avoid simultaneous deployment across multiple social media platforms. Master one before adding another.

- Ignoring Your Existing Clients: The easiest person to market to is someone who already trusts you. Create a simple email newsletter to stay in touch and encourage referrals.

- Not Having a Clear Call-to-Action (CTA): Every piece of marketing should tell the audience what to do next ("Book a Free Consultation," "Download Our Guide," "Call Today").

Step 13: Ongoing Compliance & Risk Management

Opening your doors is the starting line, not the finish line. Maintaining compliance is an ongoing process that protects your business and your clients. An annual compliance calendar is an excellent tool to ensure critical deadlines and tasks are not missed.

Annual Compliance Calendar

| Task | Frequency | Quarter |

| Renew Professional License | Annually/Biennially | Varies by State |

| HIPAA Security Risk Assessment | Annually | Q1 |

| Update Policy & Procedure Manual | Annually | Q2 |

| Complete Continuing Education (CE) | As Required | Q3/Q4 |

| OSHA Training (if applicable) | Annually | Q4 |

One of the most crucial ongoing tasks is the annual HIPAA Security Risk Assessment. This is a mandatory self-audit where you identify potential vulnerabilities in how you handle protected health information. Additionally, have clear protocols for documenting any incidents, as proper documentation is your best defense.

Next Steps

Launching a private practice is a significant undertaking, but it is achievable with a clear plan and methodical execution. By following these steps, you have built a comprehensive framework for a thriving, compliant, and profitable wellness business.

Practice development should be approached as a long-term strategic initiative rather than a short-term endeavor. There will be challenges and learning curves along the way. Embrace the mindset of "progress beats perfection." Take one step at a time and don't hesitate to seek guidance from mentors, lawyers, and accountants.

References

- Business Associate Agreement. (n.d.). https://aasm.org/resources/pdf/accred/baafactsheet.pdf

- CDC. (2024, September 10). Health Insurance Portability and Accountability Act of 1996 (HIPAA). CDC. Retrieved September 23, 2025, from https://www.cdc.gov/phlp/php/resources/health-insurance-portability-and-accountability-act-of-1996-hipaa.html

- Choose a business structure | U.S. (2025, March 7). Small Business Administration. Retrieved September 23, 2025, from https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

- Employer identification number | Internal Revenue Service. (2025, July 31). IRS. Retrieved September 23, 2025, from https://www.irs.gov/businesses/employer-identification-number

- Marshall, E. F. (n.d.). Professional Limited Liability Company(PLLC). Secretary of State. https://www.sosnc.gov/manual/register_a_foreign_business/professional_limited_liability_company

- Nasseh, K., & Vujicic, M. (2018, June 29). Earnings of Employed and Self-employed US Health Care Professionals, 2001 to 2015. JAMA Network. https://pmc.ncbi.nlm.nih.gov/articles/PMC6324410/

- Popover, J. L., Jones, T., Kalathia, C., Mackey, A., King, N., Sardzinsky, E., Oulton, Z., Imam, A., Al-Masri, M., & Toomey, P. G. (2025, May 13). Physician Employment in America: Private Practices Dominate Despite Increased Hospital Employment. Journal of the Society of Laparoscopic & Robotic Surgeons. https://pmc.ncbi.nlm.nih.gov/articles/PMC12072973/

- United States Patent and Trademark Office. (n.d.). United States Patent and Trademark Office. Retrieved September 23, 2025, from https://www.uspto.gov/